Catching up on Q3 results from European airlines

Stuttering profit engines

I’ve been a bit busy on other projects recently and haven’t had much time to dig into the latest European airline results. But with most of the Q3 results for the big carrier now published, I thought a quick catch up would be in order.

At the start of the year, there were mixed views on whether 2024 would be as good as 2023, or whether we’d see a downward correction due to recessionary risks and the dissipation of post COVID pent-up demand. I was personally at the more optimistic end, expecting profits at the big carriers to remain fairly stable.

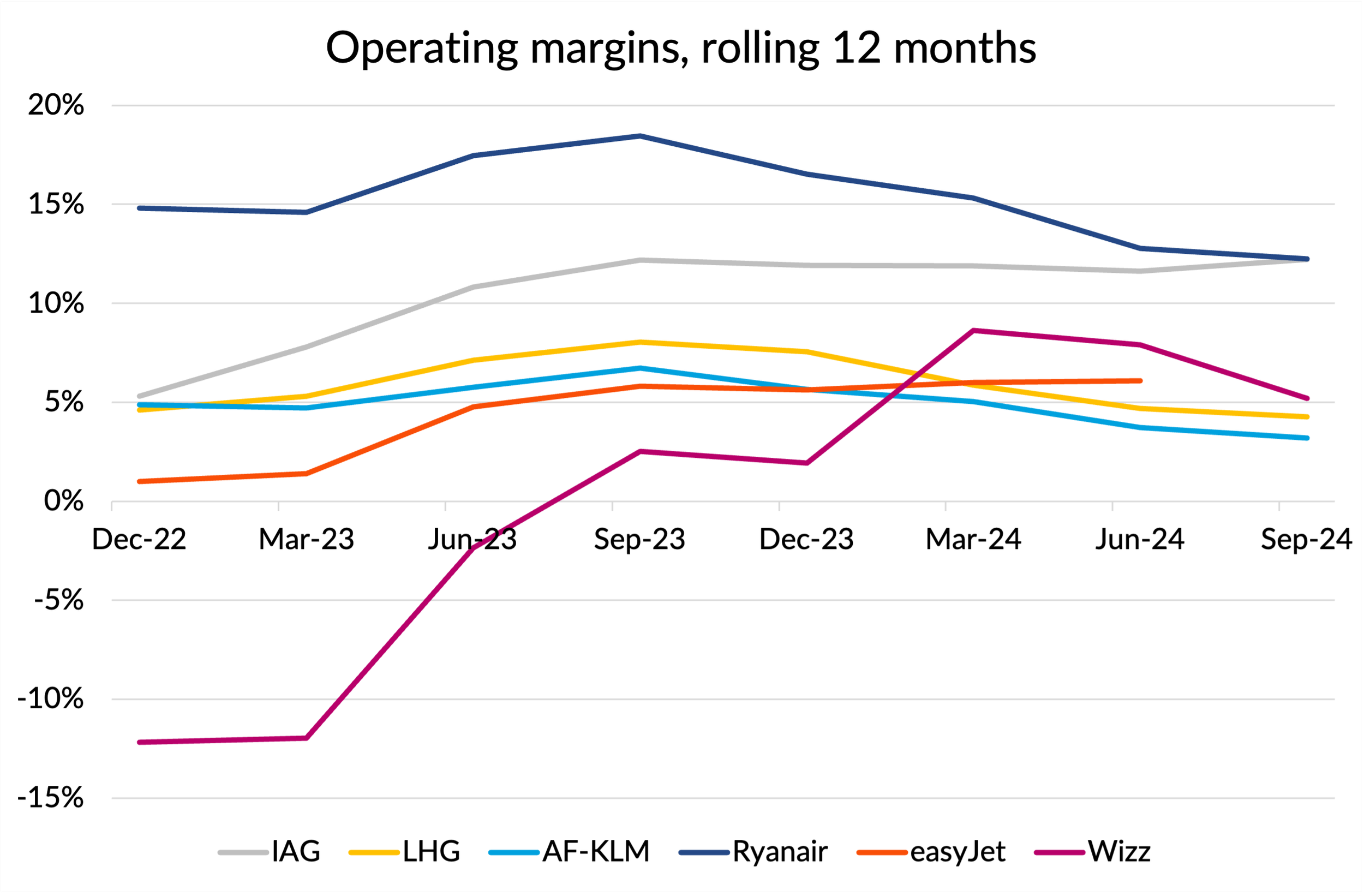

With three quarters of the year gone, it is now evident that for most carriers, margins have indeed dropped back compared to 2023 (see the chart below). But by the standards of previous airline profit cycles, the reduction has been modest, with an overall reduction in the profitability of the “big six” Western European airlines of about 2.5 points on a rolling 12 months basis to Q3 compared to last year.

Source: Company reports, GridPoint analysis

Some carriers have bucked the trend, notably IAG, who have stretched their already significant margin lead on the other two big network carriers. Both of them were hit by some one-off issues: Air France - KLM blamed the Olympics for their poor performance in Q3 and Lufthansa’s Q1 results were hit by strikes. But it is important not to overstate the significance of these in explaining the performance gap to IAG. On a rolling 12 month margin basis, these one off issues were worth about half a margin point at AF-KLM and one point at Lufthansa.

Amongst the low-cost carriers, Ryanair have been on a downward trend since peaking last year, although profitability remains strong. We don’t yet have Q3 results for easyJet, but they were on an improving trend for the first half of the year, admittedly from a low base. Wizz have been on something of a roller coaster ride, initially posting sharply better figures after an awful 2023, but they’ve fallen back in Q2 and Q3, hit by continuing issues with their P&W GTF engines.

Revenue performance

Revenue performance was a bit more consistent across the airlines and to my mind was remarkably stable, especially given the worries expressed by many commentators going into the year about the sustainability of 2023 pricing levels. The following chart shows unit revenues as measured by Revenue per ASK (RASK). I’ve looked at them on a rolling 12 month basis, to eliminate the effect of seasonality, and I’ve also indexed the figures to 2022 levels to make the trends easier to see. I should point out that the Y-axis on this chart is not zero-based, which exaggerates the changes. The main points to note I think were the strength of Ryanair and easyJet in 2023 and the ongoing weakness at Lufthansa, at least compared to 2022 levels. The German economy has been the poorest performing of all the G7 economies for two years running now. In 2023, it was the only one to see negative growth, an achievement which seems likely to be repeated in 2024.

Source: Company reports, GridPoint analysis

The bottom line

IAG and Ryanair’s superior margin performance translated into much higher profits in absolute terms, whether you measure that at an operating level or after financing costs. You can see from the following chart that these two airlines made up the vast majority of profits amongst this group, accounting for two-thirds of pre-tax profits, despite representing only 40% of capacity.

Note: 12 months to September 2024, except easyJet which is 12 months to June.

Stock market valuations

To an extent, that profitability difference has translated into stock market valuations, with the same two companies accounting for two thirds of the combined stock market valuation. But there is a big difference between the price/earnings ratios of Ryanair (13.5 times last 12 months net income) and IAG (a measly 5.1x). IAG’s rating is actually the lowest on the chart, despite matching Ryanair’s profit margins and delivering the best recent profit trends. Despite having post-tax profits which are 80% bigger than Ryanair, IAG’s market capitalisation is less than 40% of Ryanair’s.

Source: Financial Times, GridPoint analysis

I struggle to explain the higher P/E multiples at Lufthansa and Air France - KLM compared to IAG. Given the current low margins at both carriers, I suppose there is more potential for a profit recovery than at IAG, which is already at or close to record profitability. But the margin gap is far from a new thing and where airlines are concerned, investors tend to put a bigger weight on profits today rather than “jam tomorrow”. IAG’s shares have performed strongly recently (up 54% on this time last year), but the company must still be feeling a little frustrated at their lowly P/E rating despite a consistently strong profitability record.

Amongst the low-cost carriers, I’m sure that Ryanair deserves its premium rating, with a rock solid balance sheet, low costs, best in class profitability and a good growth story. Their main issue is Boeing’s struggles with delivering aircraft, but a period of lower growth than planned will no doubt be helpful for margins in the short term.

Outlook for profitability in 2025

There are some reasons to be optimistic about airline profits in 2025. Current fuel prices of circa $725 per tonne should be supportive of profitability and capacity remains quite controlled due to shortages of aircraft and maintenance spares. Whilst that is frustrating for airlines waiting for delayed deliveries or struggling with grounded aircraft, aviation profitability is heavily driven by supply/demand balances and the shortages will help support overall pricing.

I assume that the main reason airline valuations remain low is concern about recessionary risks going into 2025. With the network airlines in particular being notoriously susceptible to the economic cycle, it is not an easy moment to convince investors to heavy up on airline stocks, however attractive the valuations look based on current profitability.

Will recessions trigger a collapse in profitability next year? Or will we see another year where the industry “bumps along”, with individual airline situations more important than overall trends in driving performance?

Only time will tell.